Summit for a New Global Financing Pact: conclusions and next steps

Publié le 29/06/2023.

| Focus 2030 published a Special Edition to present the issues at stake at the Summit for a New Global Financing Pact, and the solutions it could bring. In this dossier, you’ll find facts and figures, infographics, experts’ interviews, citizen mobilization campaigns, and opinion survey results related to the Summit. |

Summit proceedings

The Summit for a New Global Financing Pact was held on June 22 and 23, 2023 in Paris. It brought together some 40 heads of State and government, over 120 NGOs and NGO coalitions, more than 40 international organizations and over 70 partners from the private and philanthropic sectors. These actors came together on June 22 for a series of six official round tables and 50 thematic side events at the Palais Brongniart, the OECD and UNESCO. In addition to the official Summit program, some 30 affiliated events were also organized.

At the end of the two-day meeting, several documents were published to conclude the discussions and enshrine the directions taken during the event.

A summary of discussions was presented at the Summit’s closing ceremony, followed by the publication of a Paris Agenda for People and the Planet and a proposed roadmap to put the implementation of the Summit’s commitments in favor of a new global financing pact on the international agenda. A call to action for Paris aligned carbon markets and a vision statement for a common vision of multilateral development banks were also made public.

Outcomes of the Summit

Given the scale of the challenges to be met, expectations for the Summit were high. A number of outcomes were envisioned: collective momentum for new international taxes, effective reallocation of Special Drawing Rights, and progress on the reform of multilateral development banks in particular.

As the Summit was not part of an institutional multilateral framework like the United Nations, and as only two G7 countries were represented at the highest level (France and Germany), it was not expected that the meeting would result in a complete reform of the international financial architecture; it aimed to initiate or accelerate initiatives to mobilize additional funds for the fight against poverty and climate change.

Nevertheless, the Summit brought to the front of the stage many heads of State and government from the global South, who were able to openly point the finger at the lack of commitments from the international community, and particularly the countries of the North, to solve the crises facing their countries.

- UN Secretary-General António Guterres has called on stakeholders to create a “new Bretton Woods moment”, notably through the reallocation of more Special Drawing Rights (SDRs), the creation of a mechanism for issuing new SDRs in the event of a climate crisis, the implementation of innovative financing mechanisms and an end to fossil fuel subsidies.

- The President of Kenya, William Ruto, called in particular for an in-depth reform of the international financial institutions to improve the repartition of decision-making power in these bodies and, ultimately, the distribution of resources.

- Brazilian President Luiz Inacio Lula da Silva has reiterated his commitment to “zero deforestation” of the Amazon by 2030, and has made several references to the climate debt owed by the countries of the North to the countries of the South.

- Gustavo Petro, President of Colombia, urged the attendees to create a new Marshall Plan to finance climate action, notably through a new allocation of Special Drawing Rights to a new fund dedicated to tackling the climate crisis.

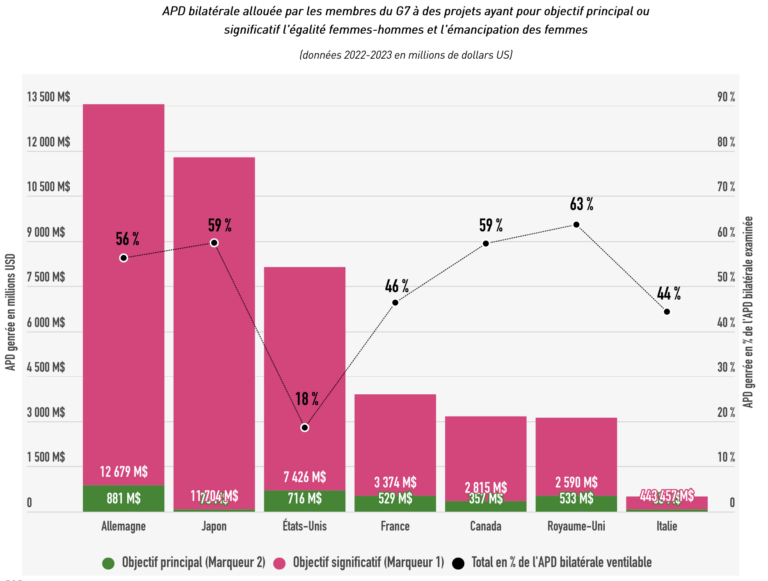

- Melinda French Gates, co-chair of the Bill & Melinda Gates Foundation, also called for a reform of the international financial architecture to rethink policies in favor of climate and the planet, digital technologies, and women’s empowerment.

A number of concrete advances were also announced during the two-day Summit:

- G20 countries’ 2021 commitment to redistribute the equivalent of $100 billion in Special Drawing Rights is reportedly on track, as International Monetary Fund Managing Director Kristalina Georgieva announced during a roundtable discussion. However, dedicated mechanisms at the IMF currently allow only 40% of the promised amount to be redistributed to low- and middle-income countries. The IMF announced an increase in the capacity of the Resilience and Sustainability Trust to $60 billion, which would raise the total amount that could be reallocated through the IMF to 80% of the total pledge. New mechanisms will therefore have to be put in place, notably within multilateral development banks, and the summit did not allow concrete advances. In addition, the $100 billion total includes a pledge of $21 billion from the United States, which has yet to be approved by the US Congress.

- According to a study by economists Amar Bhattacharya and Nicholas Stern presented at the Summit, the $100 billion annual pledge for climate action should be reached in 2023, three years after the deadline. However, this announcement will have to be corroborated by data collected by the OECD.

- While no concrete progress has been made on the reform of multilateral development banks (MDBs), the Paris Agenda for People and the Planet, published at the end of the Summit, calls for an increase in MDBs lending capacity of $200 billion over the next ten years, including the 50 billion increase in World Bank lending announced at the Spring Meetings in April 2023. Although welcomed, this increase remains modest in relation to MDBs’ potential lending capacity.

- The new President of the World Bank Group, Ajay Banga, announced a series of new measures designed to support countries in their response to crises. Among them, clauses suspending debt repayment in the event of natural disasters will gradually be included in World Bank loan contracts. A coalition of countries supporting this measure has also emerged, some of which have pledged to implement these clauses by COP28. These commitments do not, however, include the suspension of debt service in the event of a pandemic or other external shock.

- Twenty-three countries supported the adoption of the principle of a tax on greenhouse gas emissions from the international shipping sector. Negotiations will continue within the framework of the International Maritime Organization.

- After two and a half years of negotiations, an agreement on the rescheduling of $6.3 billion of Zambia’s debt has been reached with several creditor countries, including China, within the Public Creditors’ Committee on the treatment of Zambia’s debt.

- Senegal and G7 countries have agreed on a $2.5 billion Just Energy Transition Partnership (JETP), to raise Senegal’s share of renewable energy to 40% by 2030.

- In addition, a coalition of foundations pledged at the Summit to mobilize new investments to combat poverty and inequality and support climate action and the achievement of the SDGs.

What’s next?

A roadmap was presented at the end of the Summit to ensure that the commitments made at the meeting are kept on the international agenda. The roadmap details the joint measures to be taken in the run-up to the major international events of 2023 and 2024. The main upcoming events are as follows:

- September 4-6, 2023: African Climate Action Summit – Nairobi, Kenya

- September 4-6, 2023: Finance in Common Summit – Cartagena, Colombia

- September 9-10, 2023: G20 Summit – New Delhi, India

- September 18-19, 2023: SDG Summit – New York, United States

- October 13-15, 2023: World Bank and IMF Annual Meetings – Marrakech, Morocco

- November 10-11, 2023: 6th Paris Peace Forum – Paris, France

- November 30-December 12, 2023: COP28 – Dubai, United Arab Emirates

- February 14-15, 2024: International Energy Agency 50th Anniversary Ministerial Meeting

- April 15-20, 2024: World Bank and IMF Spring Meetings

- April 22-25, 2024: United Nations Forum on Financing for Development

- September 22-23, 2024: Summit of the Future

- November 18-19, 2024: G20 Summit – Rio de Janeiro, Brazil

A monitoring mechanism will be set up to assess progress on the roadmap every six months. A follow-up meeting will be held in 2025 to take stock of this initiative. The Summit also saw the launch of the Paris Dialogue on Financing for Sustainable Development, an international platform designed to support multilateral discussions on financing for sustainable development and to “keep the spirit of the Summit alive”.

Civil society reactions

While the Summit for a New Global Financing Pact allowed some progress, civil society organizations agree that these announcements are not sufficient considering of the scale of the challenges facing the planet.

This is particularly the case for Climate Action Network International, which considers that the Summit failed to propose real transformations of the international financial system, and Oxfam France and CARE France, who regret that the Summit did not result in any concrete measures.

Global Citizen, ONE France and the Centre for Science and Environment welcome some encouraging advances (suspension clauses, SDRs, restructuring of Zambian debt), but also express their disappointment at solutions deemed insufficient. Climate activist Olumide Idowu, coordinator of ICCDI Africa, considers the progress made at the Summit to be promising, and calls for continued efforts at future international meetings. CCFD-Terre Solidaire considers that the Summit has helped to reinforce “an existing and failing system”, and regrets the absence of discussions on international taxation; Don’t Gas Africa warns of certain clauses in the JETP concluded with Senegal during the Summit, and warns that this agreement could paradoxically reinforce the country’s dependence on fossil fuels (gas); finally, Greenpeace deplores the absence of explicit recognition of the polluter-pays principle during this meeting, regretting the announcement effects. Iolanda Fresnillo, policy and advocacy manager at Eurodad, describes the Summit as a “distraction” and calls on the international community to focus its efforts on more legitimate and egalitarian multilateral processes. A webinar was also organized by the Center for Economic and Social Rights, Eurodad, Climate Action Network France and International and Budget Advocacy Network to take stock of the Summit, during which speakers reiterated the needs for reform of the international financial architecture that were not met by the Summit.

| On the sidelines of the Summit for a New Global Financing Pact, the Bill & Melinda Gates Foundation released a “white paper” which examines strategies for policymakers to promote sustainable development, alleviate poverty, and create more resilient opportunities for their populations in the face of climate change, all while embracing eco-friendly approaches to economic organization.

According to the authors, addressing climate-resilient development in a context of limited funding necessitates taking action on two fronts:

In addition to the aforementioned short-term priorities, considering the substantial financing requirements, it is also crucial to expand the scope of development financing by incorporating the following elements:

Climate and Development Finance: A transition framework for all |